La pandemia ha afectado muchas cosas a la hora de rendir cuentas al Tío Sam. Este año si recibiste beneficios de desempleo durante la pandemia podrías deber dinero de impuestos.

Para muchas familias azotadas por la pandemia, las devoluciones de impuestos serán drásticamente menores este año. Incluso, algunas personas descubrirán que deben dinero al IRS.

Beneficios de desempleo

Si recibiste beneficios de desempleo, recuerda que esas prestaciones están sujetas a impuestos.

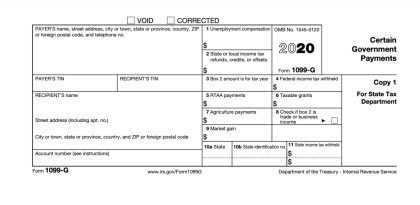

Tu formulario 1099-G te muestra cuánto te han pagado de beneficios y cuánto has pagado en impuestos federales y estatales.

Retener tus impuestos de tus beneficios de desempleo es opcional. Por ello, muchas personas que perdieron su empleo durante la pandemia no sabían que deberían pagar impuestos por sus beneficios y decidieron no retenerlos.

En resumen: si recibiste beneficios de desempleo y no elegiste retener una porción para tus impuestos, tendrás que pagarlos al IRS, algo así como el 10%.

Ojo: son los beneificios de desempleo pagados a todos los que perdieron su trabajo durante la pandemia los que serán sujetos a los impuestos.

Debido a todos los cambios que hay este año, se recomienda iniciar el proceso de declarar tus impuestos lo antes posible y consultar con un profesional.

9/11COMPARTECabe mencionar que no deberás pagar impuestos sobre los cheques de estímulo, como los cheques de 1,200 dólares enviados el año pasado y los 600 enviados este año.

El IRS comenzará a aceptar las declaraciones de impuestos federales el 12 de febrero.

La fecha límite para pagar estos impuestos es el 15 de abril.

PODRÍA INTERESARTE:

Enfermero de Laredo recibe acusación formal por muerte de su esposa